Paycheck calculator ma with deductions

Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. Fill Out Quick Form - Get Free Quotes - Save.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Ad Process Payroll Faster Easier With ADP Payroll.

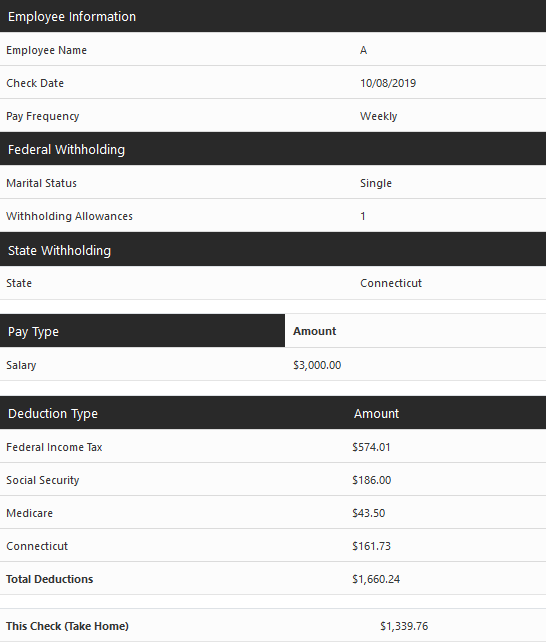

. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Compare Deals Side By Side. The formula is.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use Gustos salary paycheck calculator to determine withholdings and calculate take.

Calculating paychecks and need some help. For post-tax deductions you can choose to either take the standard. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

It can also be used to help fill steps 3. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Simply enter their federal and state W-4.

This contribution rate is less because small employers are not. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Get No Obligation Quotes From Local Payroll Services.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Whats The Best Payroll Service. Just enter the wages tax withholdings and other information. Ad Process Payroll Faster Easier With ADP Payroll.

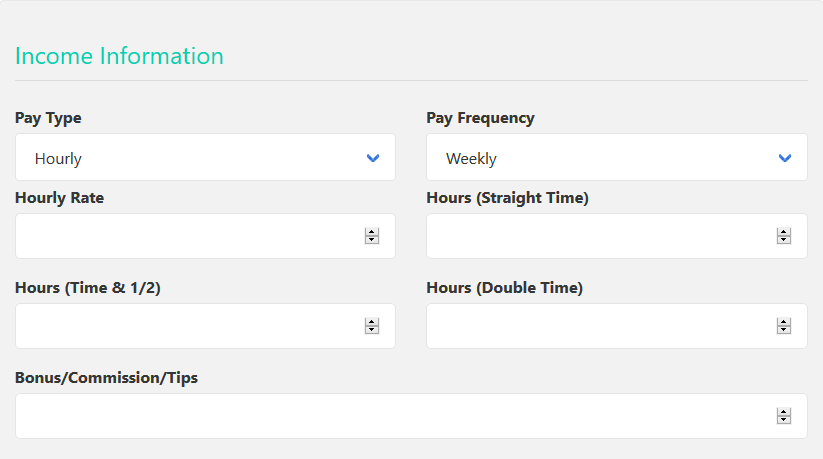

Massachusetts Hourly Paycheck Calculator. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Massachusetts Salary Paycheck and Payroll Calculator.

Adjusted gross income Post-tax deductions Exemptions Taxable income. New employers pay 242 and new. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

All Services Backed by Tax Guarantee. Discover ADP Payroll Benefits Insurance Time Talent HR More. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. Get Started With ADP Payroll.

Paycheck Calculator Salaried Employees Primepay

Paystub Calculator Check Stub Maker

Massachusetts Paycheck Calculator Smartasset

Paycheck Manager Expert Review Pricing Alternatives 2022 Selectsoftware Reviews

How To Calculate Taxes On Paycheck Sale Online 54 Off Www Ingeniovirtual Com

Massachusetts Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ready To Use Paycheck Calculator Excel Template Msofficegeek

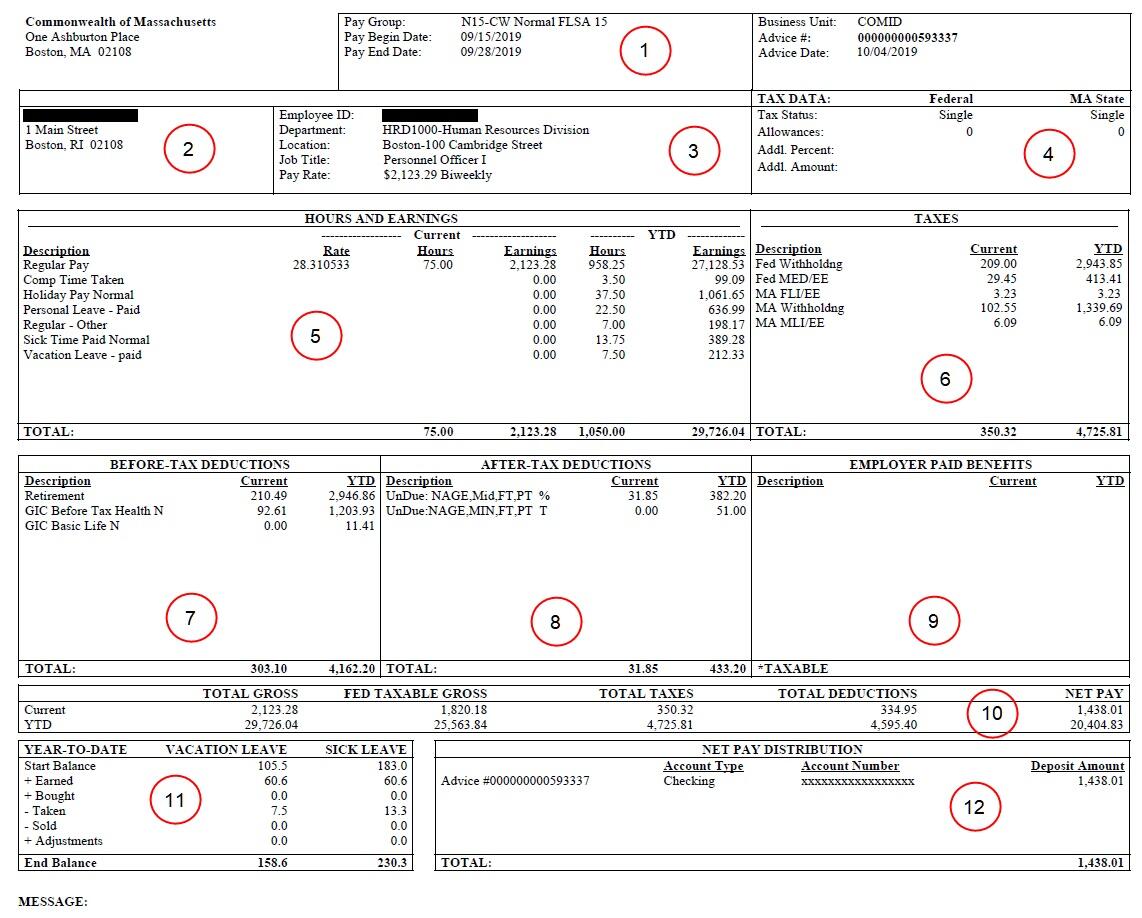

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Free Paycheck Calculator Hourly Salary Usa Dremployee

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

62 Free Pay Stub Templates Downloads Word Excel Pdf Doc

401k Calculator Paycheck Outlet 50 Off Www Ingeniovirtual Com

Payroll Calculator Free Employee Payroll Template For Excel

Free Paycheck Calculator Hourly Salary Usa Dremployee

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Payroll Software Solution For Massachusetts Small Business